The Case For Gold

Gold as A Diversifier

Gold possesses attractive risk/return characteristics for "all weather" portfolios as it can serve as a hedge against important risk factors (inflation, currency and credit risk to name a few). Gold also works as a powerful diversifier as it trades in a largely uncorrelated (or slightly negatively correlated) fashion vs. stocks and bonds which is highly desirable for portfolio immunisation and diversification.

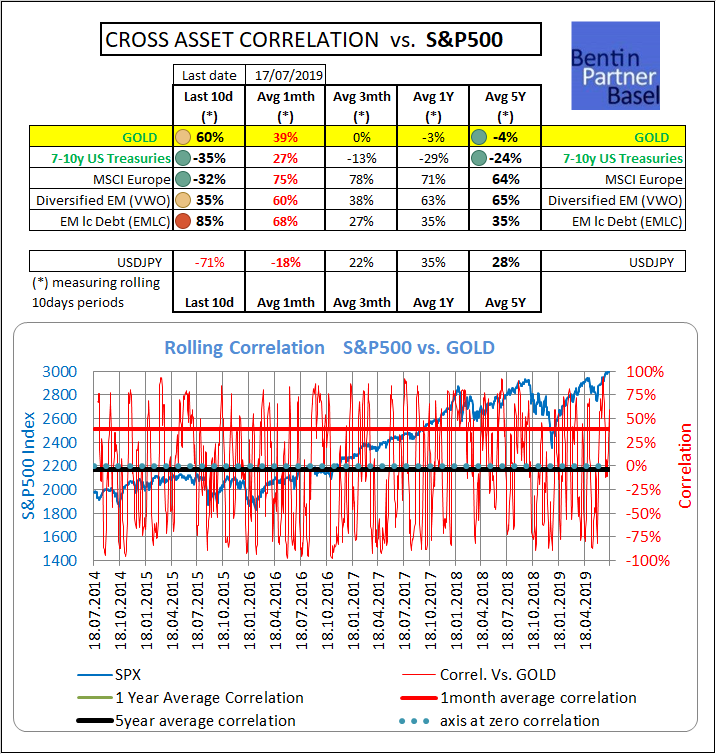

The table below shows that Gold, over the last 5 years, exhibited a near 0% correlation with the S&P500. By implication, this means that gold does not necessarily serve as a hedge against adverse stock markets performance (although it did in many cases in the past) but that precious metals' performance has “little to nothing” to do with the daily stock market’s gyrations. This is an attractive feature all by itself, considering how skewed towards equities most (currently performing) institutional and private portfolios have become.

Gold as An Inflation Hedge

Unlike the currencies that we use every day, gold cannot be printed; it cannot be reproduced chemically; it exists in rare quantities in the earth's crust and as such, it possesses the intrinsic value explaining why gold was able to serve as money for thousands of years.

Whenever a currency (or everything else for that matter) is produced in excess, its value tends to depreciate, sometimes violently. In the case of currencies, such depreciation is often accompanied by an inflationary outbreak as people lose confidence in their currency as a store of value and start exchanging it for goods or other currencies at an accelerating pace. Currency printing does not always end into a (hyper) inflationary cycle but it often did in the past. The reasons why it did not do so this time, despite all the money that was printed over the past 10 years, have to do with powerful and largely deflationary globalization forces still at work. The other important reason is that most central banks from developed economies have followed fairly similar policies, combining very low-interest rates with quantitative easing (QE). This situation has established a sort of equilibrium of terror where nobody really knows what currency needs to devalue vs. what other. In that context, gold still remains an unrivaled safe-haven currency.

There is perhaps one big caveat to gold's "intrinsic value" argument with the fractional paper Gold system that enabled the multiplication of gold claims well above the actual investable quantities of physical gold. Numbers have only become more difficult to come by (not least because gold lending activities have become more opaque) but it is not unreasonable to consider that there is about 1 to 4 ounces of physical gold backing every 100 ounces of paper gold in circulation. In other words, it would only take 5% of investors holding paper gold claims and asking for physical delivery to make the paper gold system untenable. In other words, again, the fractional gold system will hold together as long as people will consider that a gold claim held in book-entry form on a bank statement remains akin to gold in the hand. For all intents and purposes, this is why we advocate holding gold in physical as opposed to paper electronic form with the exception of gold held for trading as opposed to investment purposes.

Gold as A Deflation Hedge

When deflation hits, the real cost of debt increases; debt becomes more difficult to service and some debt issuers start to default or restructure. This can also trigger credit crises with more elevated global default risks and people seeking refuge in hard assets of all kinds.

One way to look at gold is to consider that it is the only financial asset which is nobody else's liability. Cash at the bank is a claim from a client to its bank. A bond is a promissory note i.e. a promise that the client will receive his money back with interest. Even a banknote is a liability from the central bank because the money supply is not backed by gold reserves anymore. Since severing the link between the monetary base and central banks' gold reserves, It has been declared by "fiat" that bank bills (maybe also to be phased out for their electronic form), represent value and have to be accepted in exchange for goods and services.

Such was the role of Gold in the past but gold will always be different. Whenever held in physical form, gold physical properties have not changed for thousands of years and never will. It will also remain nobody else's liability whenever held in an unencumbered physical form.

Gold as A Dollar Hedge

Gold is negatively correlated with the value of the USD, the de facto still current anchor of the monetary system.

However and as the dollar use in world trade is likely to progressively diminish (due to the economic ascent of emerging economies and a growing aversion of some of them to use the dollar in international trade), the need for central banks to diversify away from the USD is likely to intensify. Currently, world central banks still hold 60%+ of their currency reserves in USD. This outsized concentration will likely diminish moving "in the direction of" the economic representation of the US economy in the world economy closer to 25%. Such a transition towards a lesser dominant role for the USD in world trade and therefore central banks’ reserves should invariably cause gradual erosion of the dollar over time. This transition towards a more multipolar world monetary system has actually started and while its effects are still only barely visible, it is an irreversible trend, in our view. This gradual de-dollarisation of the world economy and of central banks reserves (which has its roots in the programmed end of the petrodollar system) will come with bumps, stops and possibly wars. It will likely be resisted, paused, braked, disrupted by the regular emergence of geopolitical, economic and monetary tensions which will bring back at times cyclical upswings for the dollar.

In our opinion and even though the process may only have started with a drop and a ripple, it will likely end with waves and tsunamis. Albeit long in its gestation, the gradual erosion of the importance of the USD in the monetary system, and although fairly politically incorrect to consider among most Bretton Woods organizations, is in preparation and will bear long term negative (to very negative) consequences for the USD, in our view, albeit not necessarily over the short term.

Central Banks Are Accumulating Gold

Central banks remain by far the largest holders of gold (32,754 tons, or about 17.8 percent of the total amount of gold ever mined, according to the World Gold Council). Those from large Emerging economies keep adding to their gold reserves (China, Russia, Hungary, Poland to name a few) in an effort to increase their still small low single digit % weight of total reserves held in gold.

If they were to consider owning as much gold as their European counterparts (which they won't because there is not enough material around), the price of an ounce of gold would instantly fetch a few 0's more. What can reasonably be assumed is that central banks in aggregate are likely to keep accumulating gold, doing so progressively and discreetly, providing both a floor and a powerful structural catalyst for gold to move higher from its depressed current level for many years to come.

Gold As The Best Performing Asset Class

Last but not least, let's remind a mostly unknown truth about Gold.

Over the past 20 years, Gold has been the top-performing asset class as per January 2020.

Interested to hear more about us?

Consider a free trial to our Daily Newsletter and subscribe.